New Developments Happening in the Blockchain Space: 03-05-2024

Image Source: Pixabay

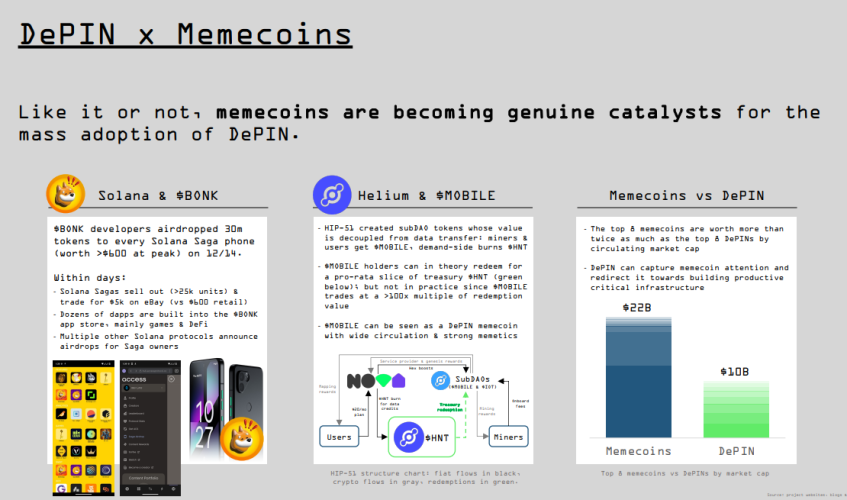

Bridging data gaps in DeFi: Oracle platforms merge to improve transparency

Oracles are critical in decentralized finance for bridging real-world data with blockchain networks, yet challenges persist in achieving accurate asset valuations and detailed credit assessments.

Gora and RociFi merge to form the DeFi Risk Oracle, integrating their strengths in data feeds and credit scoring to address DeFi’s challenges with asset valuation and risk assessment.

Access to accurate and comprehensive data is pivotal for maintaining secure and fair financial systems in decentralized finance (DeFi). Oracles play a crucial role by bridging the gap between real-world information and blockchain networks, which are inherently isolated.

Despite the integration of oracles, the DeFi sector still grapples with issues such as ensuring precise asset valuations, essential for financial activities like loan management. Additionally, the lack of detailed, individualized credit data complicates risk assessments, which can hinder the development of customized financial products and governance systems, highlighting the need for improved mechanisms to bolster transparency and efficiency in DeFi operations. Read More

Centralized Exchanges Are Already Listing Bitcoin Runes—Which Ones Will Be Next?

Bitcoin Runes tokens are already trading via Gate.io, as other big exchanges potentially test the waters. Will widespread adoption follow?

Bitcoin’s new Runes fungible token standard launched late Friday alongside the quadrennial halving event, and the immediate demand pushed network fees to a level never before seen on the original blockchain network. Already, at least one centralized exchange (or CEX) has already taken notice and gotten in on the action.

The Cayman Islands-based exchange Gate.io has already listed three of the earliest Runes tokens on Bitcoin: SATOSHI•NAKAMOTO (no connection to the pseudonymous Bitcoin creator), MEME•ECONOMICS, and WANKO•MANKO•RUNES.

WANKO•MANKO•RUNES is the odd token out there, but the other two tokens have something in common besides the odd naming scheme with the interpunct between words (due to protocol naming conventions): They’re among the first 10 tokens etched via the Runes protocol.

There was a mad rush to launch Runes tokens on Friday when the protocol went live, so much so that it helped push Bitcoin network fees on the first several post-halving blocks into the millions of dollars combined. Read More

Bitcoin Runes Launch on Magic Eden in Attempt to 'Streamline' BTC Token Trading

Just three days after Bitcoin's Runes protocol launched, Magic Eden has rolled out support for the tokens. Here's what to expect.

Just days after the launch of Bitcoin’s buzzy Runes fungible token standard, leading cross-chain NFT marketplace Magic Eden has launched its promised Runes platform, aiming to ease some of the early headaches that traders have encountered around the tokens.

As enthusiasts grapple with the complexities of new technology, some traders have griped about the frustrations of the bumpy minting and trading experience around Runes. Whether it's running a node, minting via Xverse on Luminex, or trading on Unisat, the steep learning curve is evident.

Monday's launch of Magic Eden’s Runes platform, in beta, is the latest chapter in the company’s expanding embrace of the Bitcoin ecosystem. It has also arrived a day before its announced launch, which was originally scheduled for April 23. Read More

Scammers eye Toncoin as Telegram-TON partnership grabs headlines

Telegram’s integration of the TON blockchain and its native Toncoin token has become a honeypot for scammers promoting a referral pyramid scheme.

Telegram’s public support for The Open Network (TON) blockchain and its intention to incorporate its native Toncoin token have led to scammers targeting unsuspecting tokenholders to exploit them.

Information shared with Cointelegraph from cybersecurity firm Kaspersky outlines a cryptocurrency scam that has been attempting to steal Toncoin (TON) from Telegram users worldwide.

According to experts at Kaspersky, the scam has been operating since at least November 2023 as interest and investments in TON surged. Scammers have been promoting an elaborate referral scheme that ultimately aims to steal TON tokens from users. Read More

About The Markethive Wallet – What You Need To Know

Great news, Markethivers! The wallet is now installed on the Markethive platform. Markethive has kept its promise and delivered a complete working wallet. This mighty, robust, and secure wallet encompasses all aspects of facilitating your business and securing all your financials within Markethive, like earnings and payments, dividends paid from your ILPs, retail products, etc.

This is a significant step in the right direction for monetizing Markethive’s ecosystem as it endeavours to ensure and restore sovereignty and financial freedom increasingly being stripped from us by a global authoritarian regime. This article will illustrate what you need to know and do to access the now-operational wallet.

Understand that access and functions of the wallet are only for Entrepreneur One (E1) members at this stage. E1 members can now retrieve their Hivecoin (HVC) from their cold storage to their hot wallet. (You can do this in preparation for the forthcoming coin exchanges and your 3rd party self-custody wallet.) You can also transfer HVC to other members within Markethive via the wallet. Read More

X payments details released: App to become your bank account

X users should eventually be able to use the app’s anticipated payment features to send money to other users, buy things in stores, and even earn interest on their account holdings.

X users will one day be able to use the platform to send money to other users, purchase goods from stores, and even earn interest on the money in their accounts as one would do with a bank account, said the head of payments at X.

In an April 22 post, X payments chief information security officer Christopher Stanley said the payment capabilities of X would go beyond “just tipping” and expand to include an in-app wallet capable of storing and sending money to any other X users.

“Think Venmo at first. Then, as things evolve, you can gain interest, buy products, eventually use it to buy things in stores (think Apple Pay),” said Stanley.

Stanley added that the “end goal” of payments on X was to create a fully functioning financial ecosystem where users never have to withdraw funds to conduct typical transactions.

“The end goal is if you ever have any incentive to take money out of our system, then we have failed, you shouldn’t ever need to take money out because you should be able to do anything you need on our platform.” Read More

What Happens When the Last Bitcoin Is Mined?

Bitcoin relies on miners to be secure and functional. Miners rely on block rewards to be profitable and competitive. What happens when there’s nothing left to mine?

Imagine a world where the money supply is finite, and there’s no dollars left to print. Sounds bizarre, right? But in the realm of Bitcoin, this scenario is not only possible but inevitable.

The Bitcoin network, designed with a finite supply of 21 million coins, just hit a significant milestone: the halving just chopped its inflation rate by 50% for the fourth time since its inception. As of now, 19,688,016 Bitcoin has been mined, leaving less than 2 million to be discovered over the next 120 years. This scarcity, coupled with the increasing demand for Bitcoin, is set to reshape the cryptocurrency's future.

The roadmap to the final Bitcoin being mined is a gradual process. By 2026, 95.24% of Bitcoins will have been mined, and by 2039, this figure will reach 99.52%. The mining of the penultimate Bitcoin is projected to occur around 2093. Read More

Democracy Fails Without Cryptocurrency

Cryptocurrency is doing more than just shaking up finance; it’s giving democracy a much-needed hand. By operating free from the control of monetary authorities and in the open for all to see, cryptocurrencies like Bitcoin are giving people the power to hold their governments accountable.

Crypto will force governments, no matter how big, to reign in their spending; otherwise people will ditch the worthless paper for safer stores of value like Bitcoin. Fully decentralized cryptocurrencies provide transparency and accountability, making corruption less likely and easier to prosecute.

For those who can’t access traditional banking, cryptocurrencies are a game-changer. They offer a way to save money, make payments, and access financial services without the barriers and costs that keep most people out of the banking system.

Cryptocurrencies are also an important tool for those protesting or fighting against censorship. In places where governments control financial transactions, cryptocurrencies offer a way to move money freely. Read More

Wallets linked to Coinbase and Vitalik Buterin have millions ‘stuck’ in bridge contracts

Arkham Research tagged and notified wallet owners to look at the addresses and retrieve their funds, which have been stuck for months.

Dozens of crypto whale wallets with assets ranging from six to seven figures are stuck on multiple decentralized finance (DeFi) bridge contracts.

One of these whale wallets is linked to Ethereum co-founder Vitalik Buterin, who has over $1 million worth of assets stuck for over seven months, with other wallets having assets unclaimed for over two years.

According to a report published by crypto analytics firm Arkham Intelligence, several notable whale addresses linked to prominent crypto individuals and entities have their funds stuck in the bridge contracts for as long as two years.

DeFi bridge contracts are software protocols that allow the movement of assets and data between different blockchain networks, enabling interoperability within the DeFi ecosystem. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Thanks for visiting.

.png)

.png)