New Developments Happening in the Blockchain Space: 24-04-2024

Image Source: Pixabay

What is restaking, and how to restake Ethereum to boost rewards?

Staking Ethereum refers to using staked Ether on the Ethereum network to support the security of other decentralized protocols at the same time.

Restaking presents a novel concept in cryptocurrency security, enabling stakers to use their Ether in the consensus layer more than once. It allows stakers to increase their rewards while strengthening the security of the staking network by facilitating the deployment of liquid staking tokens with validators across several networks.

Staked tokens usually sit idle on PoS blockchains. Restaking activates staked tokens, facilitating higher staking rewards for restakers. Whether someone is staking Ethereum directly or using a liquid staking token (LST), they could use a restaking protocol such as EigenLayer to receive additional rewards on their staked tokens.

The sheer number of validators on the Ethereum network participating in the PoS consensus mechanism makes it stand out. But staked ETH lies dormant. Thanks to liquid staking protocols, the staked ETH gets converted into fungible tokens, enabling stakers to use it in decentralized finance (DeFi) applications. The mechanism sets aside the minimum 32 ETH staking cap, enabling users with smaller holdings to earn staking rewards. Read More

How to Set Up a Bitcoin Node: A Guide for Beginners

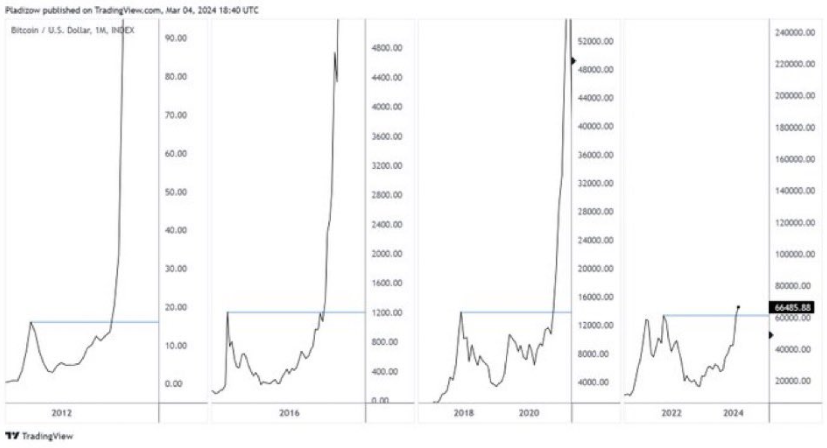

As the halving cuts miner rewards in half, there are other ways to participate in the Bitcoin network. Here are the simplest ways to connect your PC.

The Bitcoin network and its community of users is sprawling and diverse. Fans of the top cryptocurrency can participate beyond mining or inscribing dog pictures or video games by setting up a Bitcoin node, which are essential infrastructure to keep the OG blockchain decentralized and running.

While all Bitcoin miners are nodes, not all nodes are miners. A Bitcoin node validates transactions and can run on any computer with the capacity to store a copy of the full Bitcoin blockchain. Currently, the Bitcoin ledger weighs in at about 500 GB. A miner, on the other hand, validates transactions but also competes to add new blocks to the Bitcoin blockchain in order to earn mining rewards.

In this article, we will look at how to set up a Bitcoin Node using a Windows 11 PC using the Bitcoin Core software and Umbrel. Read More

Solana's mainnet beta update v1.17.31 aims to resolve congestion issues

The Solana Foundation claimed ongoing network congestion could be attributed to the high demand for Solana block space and increased network activity.

Solana developers have released a mainnet beta update, v1.17.31, to deal with the ongoing network congestion on the Solana blockchain.

The update was released on April 12, and now, after three days of testing, it is being recommended for general use by mainnet beta validators.

This patch contains enhancements that will help with some of the ongoing network congestion and will be followed by further enhancements in v1.18.

The current version will help improve the network congestion and issues with the open interest jump. Read More

Crypto sleuth warns of scammers behind DeFi protocol

The group has been linked to several rug pulls, among them Magnate, Kokomo, Solfire and Lendora.

Pseudonymous blockchain investigator ZachXBT issued a warning about a group of scammers attempting to entrap more victims in a new fraud using millions of stolen funds.

In a thread on X, ZachXBT disclosed the findings of an investigation over Leaper Finance, a lending protocol based on Blast. According to the analysis, the group is behind several rug pulls, including those that hit users of Magnate ($6.5 million), Kokomo ($4 million), Solfire ($4.8 million) and Lendora.

“In the past they let the TVL grow to 7 figs before stealing all of users funds deposited to the protocol and falsify KYC documents + use low tier audit firms. They now have launched scams on Base, Solana, Scroll, Optimism, Arbitrum, Ethereum, Avalanche, etc,” noted ZachXBT. Read More

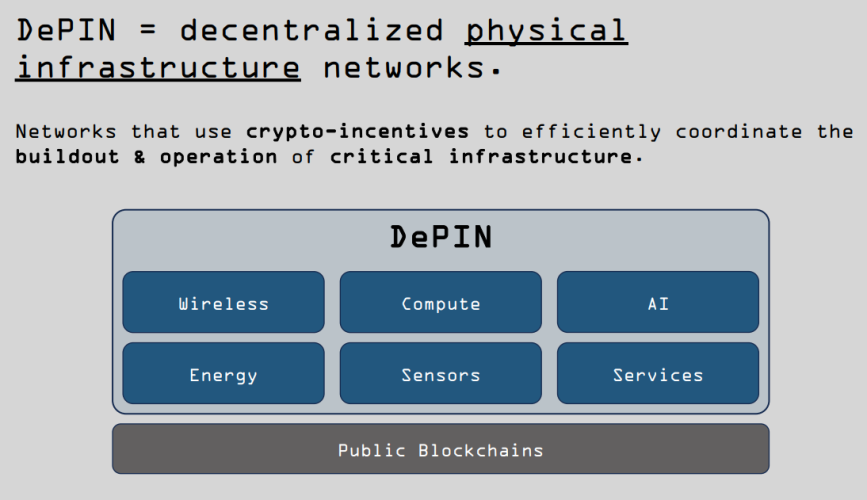

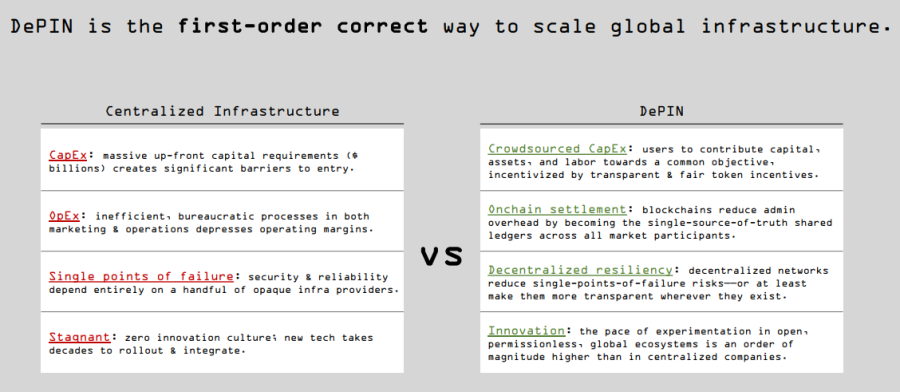

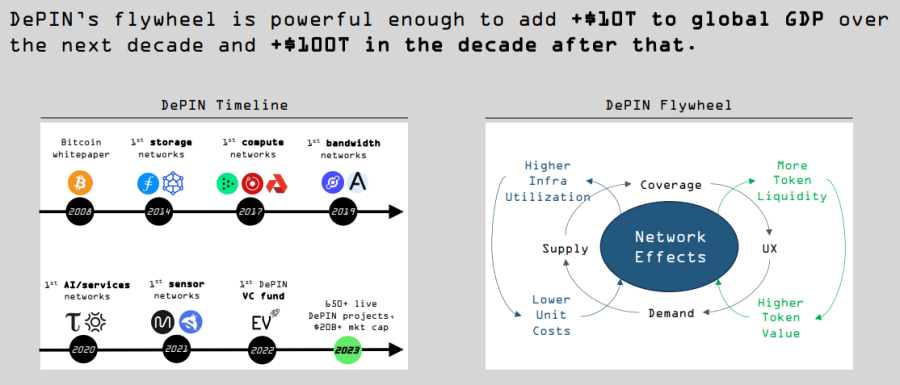

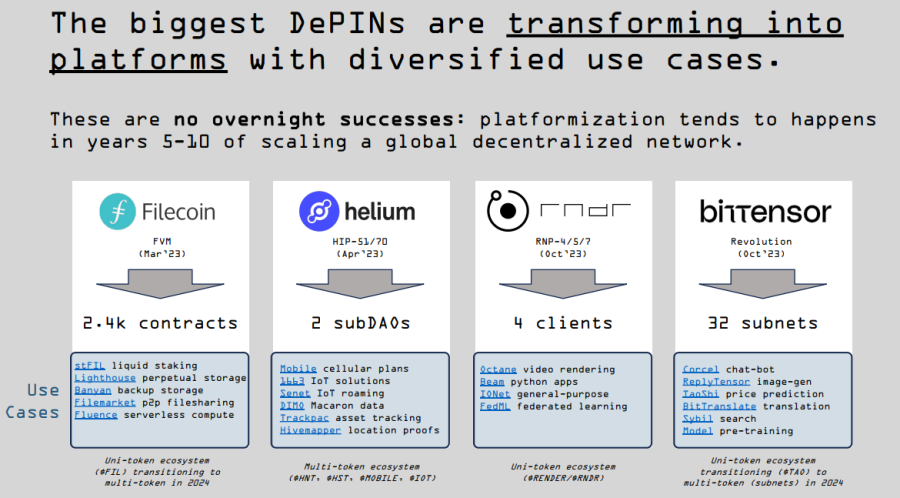

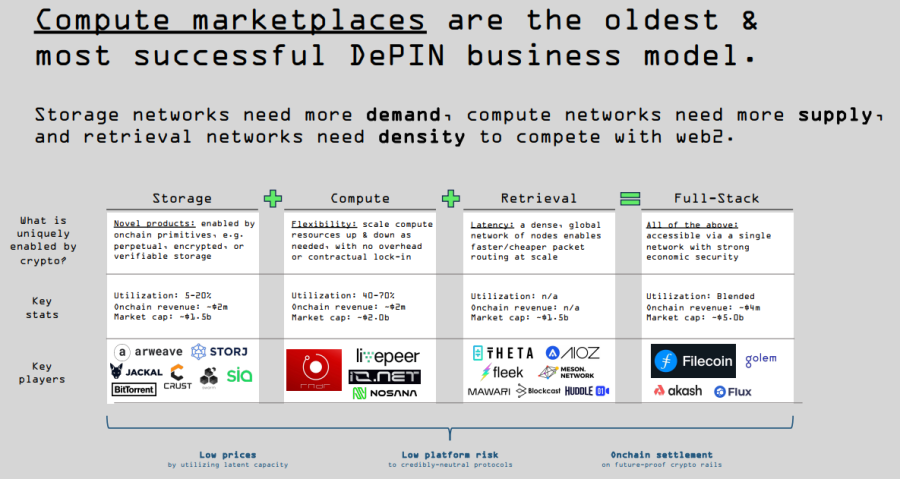

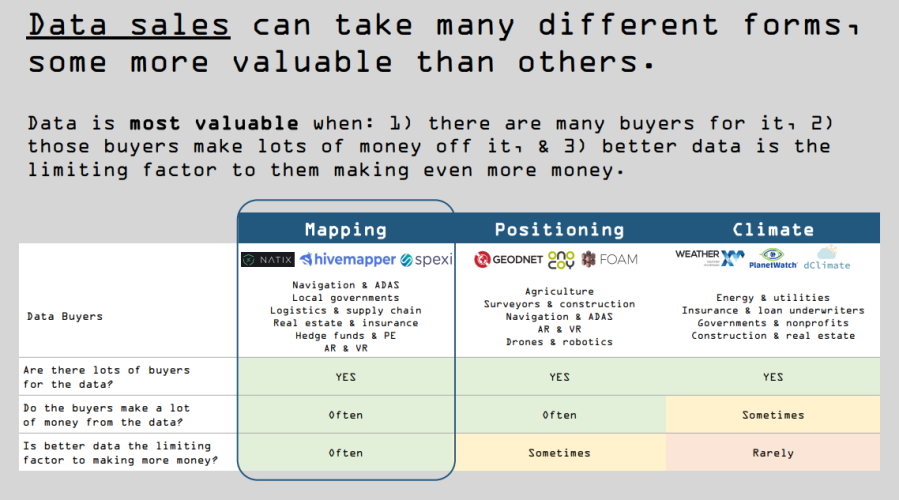

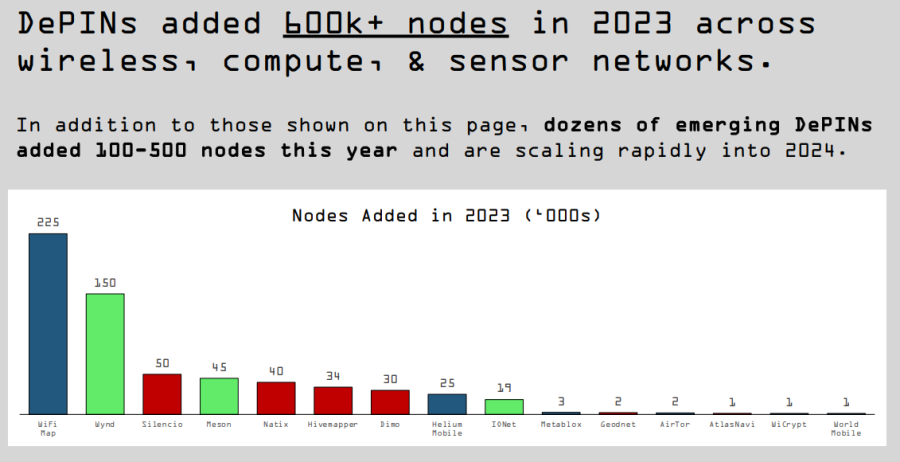

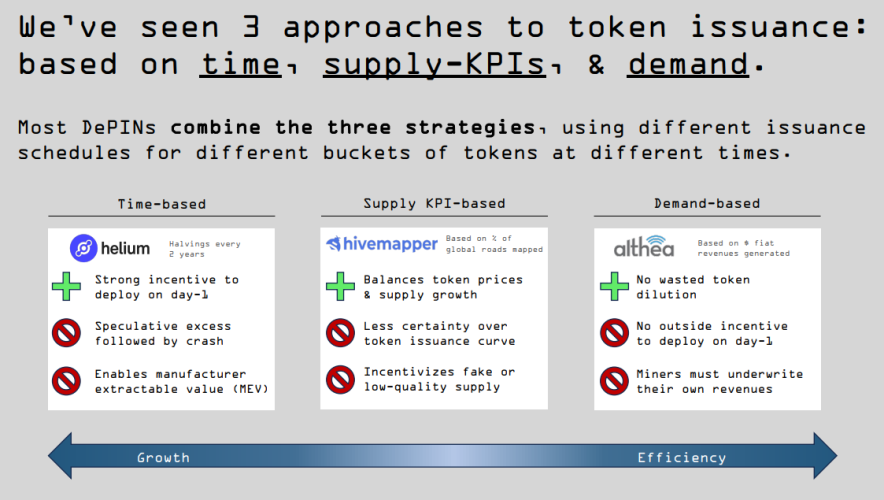

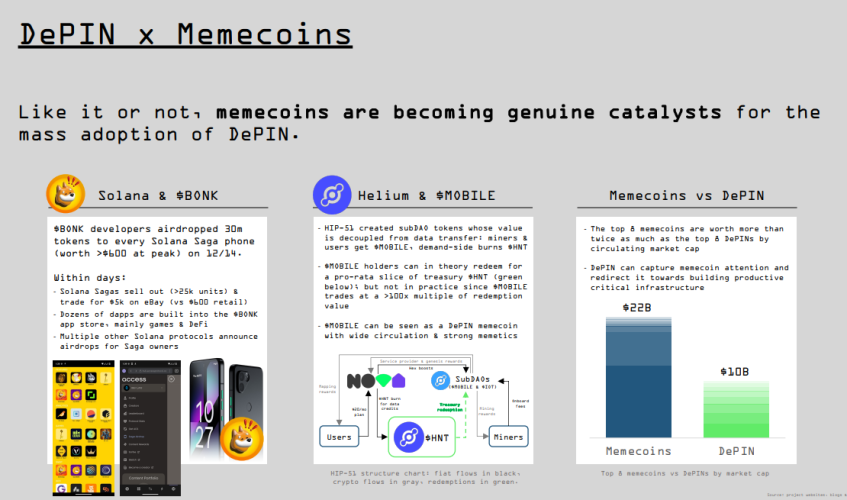

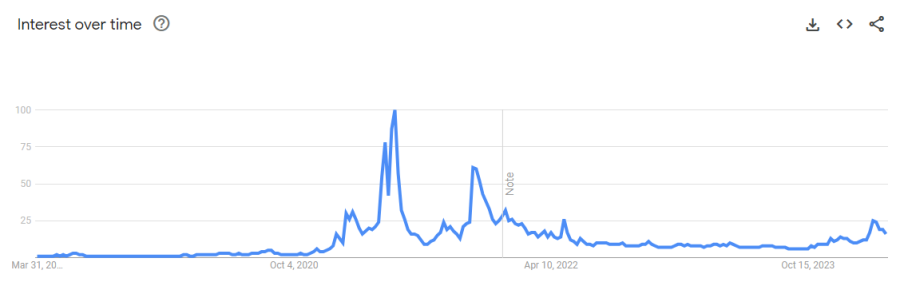

From Financial To Physical. The Next Big Thing In Crypto – DePIN

Recently, there has been significant interest in decentralized physical infrastructure, also known as DePIN, within the crypto space. People are curious about the potential of this niche and which specific projects within it are worth noting. The latest detailed study, titled State of DePIN 2023 by Messari, aims to provide insights into these questions. This summary will highlight key findings from the report and discuss their potential impact on the cryptocurrency market.

What Is DePIN?

The report commences with a concise delineation of DePIN, an acronym for decentralized physical infrastructure. It encompasses a cluster of ventures that employ cryptocurrency-based incentives to foster a range of physical infrastructure. These initiatives span from decentralized Wi-Fi systems, decentralized computing clouds, decentralized cloud storage solutions, and decentralized mobile networks to other similar endeavours. A salient feature that sets most DePIN projects apart, in addition to their crypto-based incentives, is the accessibility for individuals to contribute, provided they possess the requisite hardware. Read More

Crypto on-ramps and off-ramps, explained

Crypto on-ramps streamline transactions for both individuals and businesses by enabling them to acquire cryptocurrencies through familiar payment methods such as credit cards or bank transfers.

Crypto off-ramps facilitate the conversion of cryptocurrencies into traditional fiat currency, allowing users to withdraw their digital assets as usable funds in the conventional financial system.

Centralized exchanges provide user-friendly interfaces and integrated payment methods. Decentralized exchanges enable users to keep control of their assets. Ramps like Bitcoin ATMs and crypto payment cards are also available. Read More

Play Games, Earn Bitcoin: The Best iOS and Android Games That Pay You BTC

You can stack up satoshis while playing Bitcoin games on iOS and Android—and these are actually fun.

Did you know that there are mobile games that pay real Bitcoin for playing? These are legit games that you can download from the iOS App Store or Android Play Store, and as you play the game and watch ads between rounds or levels, you’ll stack up satoshis (aka the smallest denomination of a Bitcoin).

Granted, you’ll need to keep your expectations in check—most of these games pay out something in the ballpark of a few cents worth of Bitcoin per hour of play. Nobody’s going to get rich playing a Bitcoin-infused version of sudoku. But if you’re to play that kind of game anyway, then why not rack up a little bit of BTC along the way? Read More

Coinbase Challenges SEC’s Definition of 'Investment Contracts' in Crypto Transactions

In its latest brief, Coinbase argues that the U.S. Securities and Exchange Commission’s (SEC) application of the term “investment contract” to various cryptocurrency transactions exceeds the legal bounds set by Congress. According to the company’s court filing, this overreach could stifle innovation and place a heavy burden on the digital asset sector, which is a vital part of the modern financial ecosystem. The core of Coinbase‘s argument hinges on the necessity for an “investment contract” to involve explicit contractual obligations post-transaction, which the SEC’s current stance does not seem to require.

“The not-at-all funny thing is, we’re not alone in thinking the question of when a crypto transaction might be an ‘investment contract’ warrants interlocutory appeal,” Coinbase’s chief legal officer Paul Grewal wrote on X. The Coinbase legal chief added:

The SEC itself has made the identical arguments. In the Ripple case, they said specifically there is ‘controlling question[] of law to which there are substantial grounds for difference of opinion’ and noted ‘industry-wide significance’ of the question presented. Read More

Ethereum's Pectra Upgrade to Enhance Wallet Functionality and User Experience

Ethereum's Pectra upgrade, expected in late 2024 or early 2025, will enhance crypto wallets' user experience and functionality, enabling smart contracts and sponsored transactions, but posing security concerns.

With the introduction of its Pectra update in late 2024 or early 2025, Ethereum hopes to significantly enhance cryptocurrency wallets by adding new features and improving user experience. Ethereum Improvement Proposal (EIP) 3074, one of the main recommendations of the update, would allow regular cryptocurrency wallets to operate like smart contracts, including transaction bundling and sponsored transactions.

A number of improvements to cryptocurrency wallets will be brought forth by the Pectra update, giving consumers a more streamlined and effective experience. Users will benefit from transaction bundling—which enables many transactions to be bundled together and processed as a single transaction—with the addition of EIP 3074. This function can lower transaction costs and boost productivity.

The update will also make sponsored transactions possible, enabling users to store assets in wallets that aren't Ethereum-based yet still have access to the Ethereum network's features. With the help of this functionality, users will be able to engage with dApps and take advantage of Ethereum's ecosystem without having to physically own Ether. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Thanks for visiting.

.png)

.png)